tax loss harvesting wash sale

Since the shares were bought back within 30 days of the sale the wash sale rule applies. This works by selling an investment at a loss with.

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax-loss harvesting cannot restore losses but it can mitigate them.

. To do it you simply need to lock in a loss by selling the. The wash sale rule is avoided because December 22 is more than 30 days after November 21. The strategy known as tax-loss harvesting allows you to sell declining assets from your brokerage account and use the losses to reduce other profits.

For tax purposes the cost basis is subtracted from the investments value at the time of sale minus fees and commissions to determine any capital gain or loss. Ad Make Tax-Smart Investing Part of Your Tax Planning. What is tax-loss harvesting exactly and how do some investors use it to opportunistically reduce their tax bills.

You can achieve the same goal with a less expensive alternative approach. Tax Loss Harvesting the Wash Sale Rule. I am planning on harvesting my losses on VTI VXUS in my taxable accounts now that it has been 30-days since my last purchases on 628.

Tax Loss Harvesting and Wash Sales. Once losses exceed gains. Get more from Vanguard.

The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their. Mondays purchase would now have a cost basis of 50 per share and coincidentally be trading at 50 per share. However my last purchase of VXUS in my Roth.

Connect With a Fidelity Advisor Today. Ad Make Tax-Smart Investing Part of Your Tax Planning. Whenever you have significant losses in a taxable account you should consider tax loss harvesting selling those losses as a part of tax.

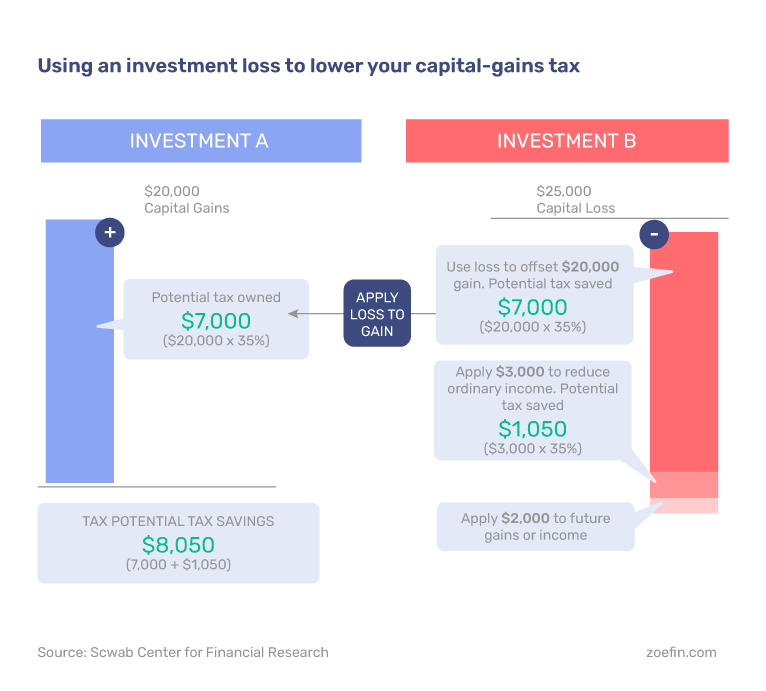

In short you can sell Security A at a loss to offset the capital gains tax liability on Security B and lower your personal. Skip to content. Market action in the past couple of weeks has probably caused many investors to begin thinking about selling some securities to.

On November 29 you buy 500 shares of XYZ again for 3200. Wash sale rule considerations Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US. The 10 unrealized gain would be negated by the.

If you enact a wash-sale you will not be allowed to claim the loss on your taxes. Even with the wash sale rule you can still utilize a tax-loss harvesting strategy with securities to lower your taxable capital gains. Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end.

The wash-sale rule keeps investors from selling at a loss buying the same or substantially identical investment back within a 61-day window and claiming the tax benefit. When you sell the new investment following the. However the second half of a properly executed tax-loss harvesting strategy involves the reinvestment of sale proceeds into similar assets to keep the portfolios overall.

To claim a loss for tax purposes. You need to add the loss to your cost basis. Connect With a Fidelity Advisor Today.

Youll want to make sure you dont inadvertently participate in.

How Tax Loss Harvesting Can Offset Gains Presented By Thestreet Turbotax Youtube

Top 5 Tax Loss Harvesting Tips Physician On Fire

Tax Loss Harvesting Napkin Finance

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting Flowchart Bogleheads Org

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Year Round Tax Loss Harvesting Benefits Onebite

Top 5 Tax Loss Harvesting Tips Physician On Fire

Tax Loss Harvesting And Wash Sales Seeking Alpha

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting Napkin Finance

How To Boost Portfolio Returns With Tax Loss Harvesting Strategies Bny Mellon Wealth Management

Do S And Don Ts Of Tax Loss Harvesting Zoe

/shutterstock_222298069-5bfc3d0dc9e77c00587b710b.jpg)

How To Avoid Violating Wash Sale Rules When Realizing Tax Losses

Tax Loss Harvesting Definition Example How It Works